Managed-Direct Ownership®

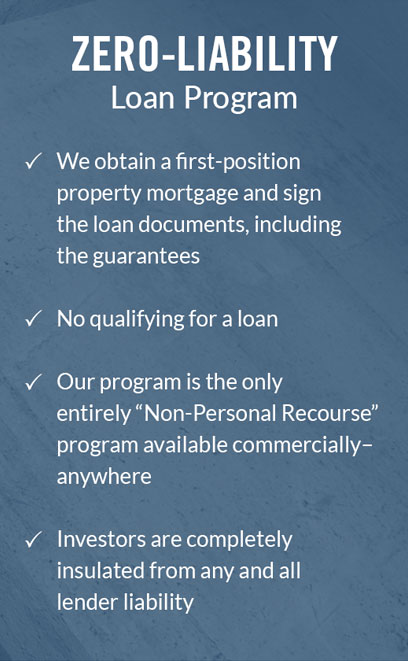

Our Managed-Direct Ownership® program is a structured real estate investment vehicle for investors who want a complete bundle of services for acquiring, financing, and managing a single property or a customized portfolio of commercial properties. After an initial consultation, you will be presented with properties best matching your stated criteria, including pricing and cash flow projections. Our cost analysis includes all costs of the transaction and are guaranteed not to be exceeded. Additionally, Kingsbarn will sign for the loan guaranties, making the mortgage truly “non-recourse.”

Our Managed-Direct Ownership® program is a structured real estate investment vehicle for investors who want a complete bundle of services for acquiring, financing, and managing a single property or a customized portfolio of commercial properties. After an initial consultation, you will be presented with properties best matching your stated criteria, including pricing and cash flow projections. Our cost analysis includes all costs of the transaction and are guaranteed not to be exceeded. Additionally, Kingsbarn will sign for the loan guaranties, making the mortgage truly “non-recourse.”

We sometimes refer to our Managed-Direct Ownership® program also as a “Structured 1031 Exchange.” We coordinate directly with your exchange accommodator so that the identification and exchange process is seamless. This “turn-key” strategy also includes all legal work, escrow and closing, and includes a tax opinion for investors who are in a 1031 exchange. This program is especially attractive for investors who want a truly managementfree investment but want to maintain control of major investment decisions.

ONE SOURCE TO MANAGE AND EXECUTE THE ENTIRE TRANSACTION

PROPERTY ACQUISITION

- We identify high-quality property targets nationally—matching our client's acquisition criteria

- We fully negotiate the terms of the sale under a Letter of Intent which is followed by a formal Purchase and Sale Agreement

- We manage the entire escrow process including the following:

- Initial deposit of earnest money from our own funds

- Identification, collection, and distribution of all due diligence materials

- Coordination of the escrow calendar

- Management and review of the loan and property settlement statements

- Initial deposit of earnest money from our own funds

PROPERTY & ASSET MANAGEMENT

- We identify a third-party property management company, which is acceptable to the lender, to professionally manage the property

- We negotiate and execute the third-party property and asset management agreement

- The property manager's responsibilities shall include the following:

- Collection of monthly rents through a cash management account held by the lender

- Payment of monthly mortgage, tax and insurance impounds, as applicable

- Payment of monthly automatic distributions as directed by our clients

- Collection of reimbursable CAM expenses (if any) from the tenant(s)

- Provision of a monthly operating statement to our clients

- Provision of a year-end tax package to our clients

FINANCING

- We identify an appropriate lender to provide the mortgage and negotiate and execute a term sheet for the loan(s)

- We make required deposits to the lender for third-party reports and lender legal fees

- We provide detailed financial analysis to the lender

- We furnish all property due diligence to the lender, attorneys, and accountants via our online document vault portal

- We obtain and review (or oversee the review) all third-party property reports, including, but not limited, to the following:

- Appraisal

- Environmental Site Assessment

- Property Survey (ALTA) and Zoning Requirements

- Property Condition Report

- Appraisal

- We negotiate and execute loan documents

- We manage the entire financing process toward the timely closing of the loan

- We provide a "warm-body guarantor" for the recourse "carve-outs" of the loan agreement, thus making the financing completely non-recourse to our clients

LEGAL

- We engage legal representation to facilitate and review the property acquisition contracts and the financing documents

- We direct legal review of the following:

- Title report(s) including obtaining the owner's title policy

- Third-party reports

- Other ancillary transaction documents

- Title report(s) including obtaining the owner's title policy

TAX OPINION

We engage counsel to provide a tax opinion that the property interests should be considered an interest in real estate and not a partnership for federal income tax purposes.

Complete the form below to request access to our MDO® program, or call 800.242.1000

To access your MDO® account, please login below.