Investor, Developer, Operator, and Manager of Real Properties &

Issuer and Portfolio Manager of Publicly-Listed and Private Investment Funds

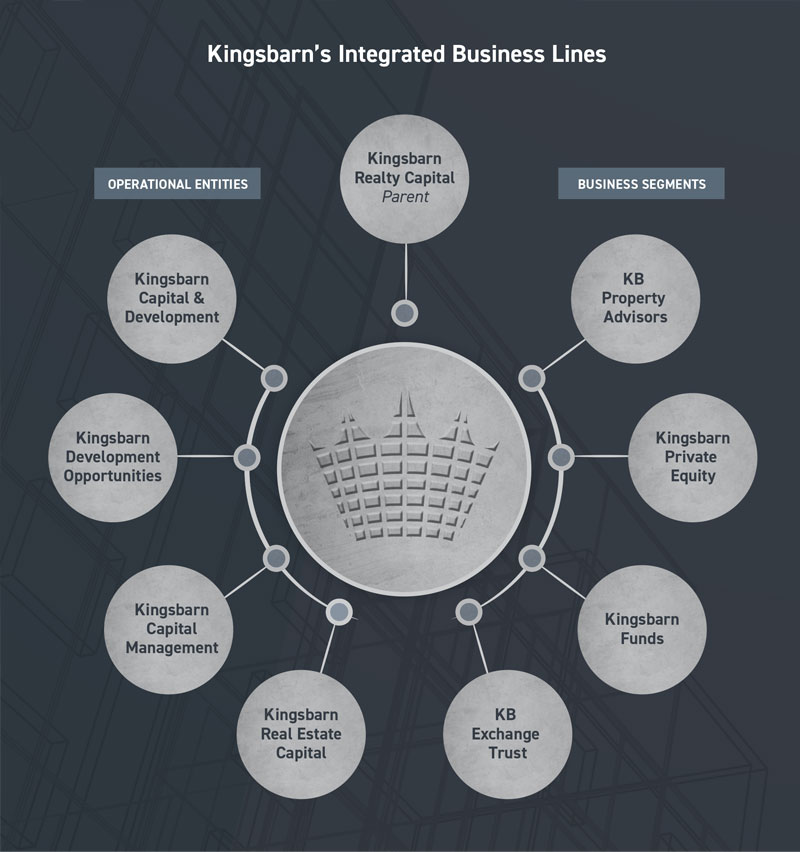

Kingsbarn Realty Capital is a real estate-centric investment house that provides institutional and accredited investors access to an array of investments. Kingsbarn offers investments in private equity, exchange-traded funds, traditional investment funds, private placements, and Delaware Statutory Trusts (DSTs).

Kingsbarn's management team has wide-ranging experience developing, managing, operating, and sponsoring a diversified portfolio of stabilized, income-driven properties, as well as ground-up construction, value-added offerings, opportunity zone investments, and entitlement projects. Kingsbarn has over $2.1 billion of assets under management and has acquired over 280 properties throughout the United States.

The company also has a current development pipeline of over $2 billion consisting of multifamily, student housing, industrial, retail, and hospitality properties. The Kingsbarn team is laden with exceptionally talented individuals who have had a significant degree of success prior to their tenure with the firm. Our team's dedication and passion drive our success.